First-Party Data, CTV & Hybrid Programmatic Models Defining Digital Advertising Growth is not just a trend headline—it reflects how the digital advertising ecosystem is being fundamentally rebuilt. As privacy regulations tighten and consumer behaviour fragments across screens, brands are moving away from dependency on third-party data and siloed buying models.

In 2026, growth is being driven by three interconnected forces:

-

First-party data ownership

-

Rapid expansion of Connected TV (CTV)

-

Hybrid programmatic buying models combining automation with control

Together, these elements are reshaping how advertisers plan, activate, and measure digital media.

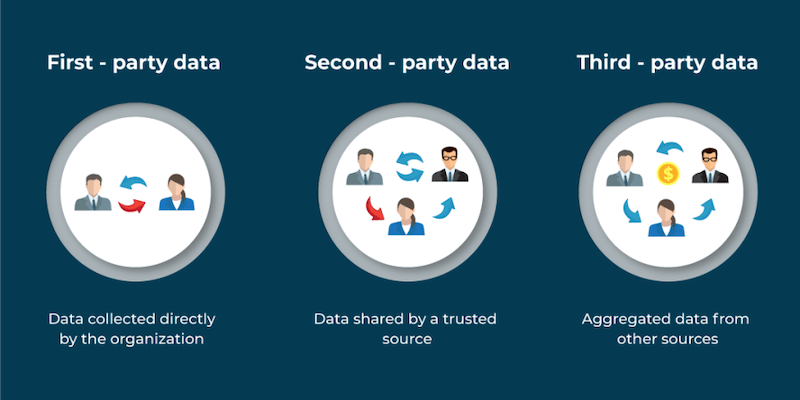

Why First-Party Data Has Become the Foundation

From Data Dependency to Data Ownership

With third-party cookies fading, brands are prioritising direct consumer relationships. First-party data now includes:

-

Website and app behaviour

-

CRM and loyalty data

-

Purchase and subscription history

-

Logged-in user interactions

As a result, first-party data-driven advertising delivers higher accuracy, compliance, and long-term scalability.

Trust, Consent, and Signal Quality

Consumers are more willing to share data with brands they trust. Therefore, first-party data signals are:

-

More reliable

-

More privacy-safe

-

More predictive of intent

This makes them the most valuable input for modern media planning.

The Rise of CTV as a Performance + Brand Channel

CTV Is No Longer Just “Digital TV”

Connected TV combines the impact of television with the precision of digital. In India and globally, CTV consumption has surged due to:

-

Smart TV penetration

-

OTT platform growth

-

Affordable data and broadband

Consequently, CTV advertising has become a core growth driver, not an experimental add-on.

Why Advertisers Are Shifting Budgets to CTV

CTV offers:

-

Household-level targeting

-

High attention and full-screen viewing

-

Brand-safe environments

-

Data-led frequency control

When powered by first-party data, CTV becomes both a branding and performance medium.

Hybrid Programmatic Models: The New Buying Reality

Moving Beyond Fully Open Programmatic

Pure open-market programmatic often struggles with:

-

Transparency issues

-

Brand safety concerns

-

Supply quality variation

As a result, advertisers are adopting hybrid programmatic models that blend:

-

Programmatic guaranteed deals

-

Curated private marketplaces (PMPs)

-

Direct publisher partnerships

-

Automated optimisation layers

This approach combines efficiency with control.

How First-Party Data Fuels Hybrid Programmatic

Audience Matching Across Channels

First-party data enables advertisers to:

-

Build consistent audiences

-

Activate them across display, video, CTV, and audio

-

Control frequency across platforms

Therefore, first-party data + hybrid programmatic ensures smarter reach, not just wider reach.

Better Measurement and Attribution

Because data originates from owned sources, brands gain:

-

Cleaner attribution models

-

More reliable conversion mapping

-

Stronger incrementality insights

This directly improves media ROI.

CTV’s Role Inside Hybrid Programmatic Ecosystems

Premium Inventory with Programmatic Efficiency

CTV inventory increasingly sits inside:

-

Programmatic guaranteed deals

-

Curated publisher bundles

This allows advertisers to access premium screens while retaining automation benefits.

Sequenced Storytelling Across Screens

CTV ads are now planned alongside:

-

Mobile video

-

Display retargeting

-

Social and native formats

As a result, brands deliver sequential messaging journeys, not isolated impressions.

Why This Trio Is Defining Digital Advertising Growth

Efficiency Without Compromising Brand Safety

First-party data ensures relevance.

CTV ensures attention.

Hybrid programmatic ensures control.

Together, they solve the biggest challenges facing digital advertising today.

Scalable Yet Privacy-Forward

This model supports:

-

Privacy compliance

-

Scalable reach

-

Future-ready data strategies

Which is why it is becoming the default growth framework for advertisers.

Impact on Media Planning and Buying Teams

Planning Becomes Audience-First, Not Channel-First

Media plans now start with:

-

Data availability

-

Audience intent

-

Screen behaviour

Channels are selected later, based on where the audience actually engages.

Buyers Become Ecosystem Managers

Modern buyers manage:

-

Data pipelines

-

Deal structures

-

Platform integrations

Thus, the role has evolved from rate negotiation to strategic orchestration.

Challenges Brands Must Navigate

Data Silos and Integration Gaps

Without proper CDPs or clean rooms, first-party data cannot scale effectively across CTV and programmatic environments.

Over-Focus on Automation

While automation helps, human oversight remains essential for:

-

Brand alignment

-

Creative context

-

Long-term equity building

Balance is critical.

What the Next Phase Looks Like

Looking ahead, first-party data, CTV & hybrid programmatic models defining digital advertising growth will expand into:

-

Cross-device household graphs

-

AI-driven creative optimisation

-

Offline-to-online data integration

-

Retail media + CTV convergence

Digital advertising will become more predictive, less reactive.

Conclusion

First-Party Data, CTV & Hybrid Programmatic Models Defining Digital Advertising Growth reflect a structural shift—not a temporary tactic. Brands that invest early in data ownership, premium video environments, and controlled automation are setting themselves up for sustainable growth.

In a privacy-first, multi-screen world, the future of digital advertising belongs to those who combine data trust, attention quality, and intelligent buying models—not those chasing scale alone.